With talk of a looming recession and interest rate hikes, money worries are at an all-time high for many Kiwis. It’s time to think about how you can support your employees to weather the storm, and stop financial stress hindering productivity at work.

Financial wellbeing and mental health are closely linked: when one drops, we often see the other follow.

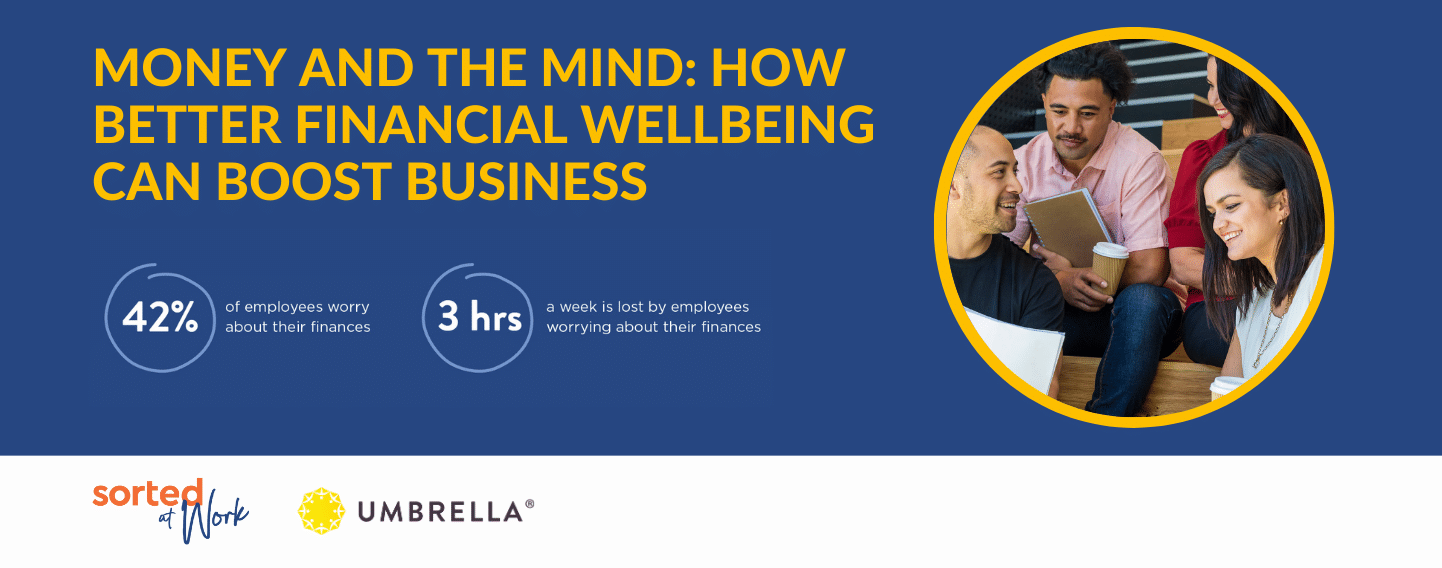

A 2019 survey from Te Ara Ahunga Ora Retirement Commission found that 42% of workers had been distracted by finances at work. One-third had spent three or more working hours each week thinking about or dealing with personal finance issues.

The survey, which interviewed 2500 full-time New Zealand employees, also found productivity loss to be higher in younger workforces, with 43% of those aged 18 to 34 spending three or more hours on personal money problems.

This issue isn’t going away anytime soon, with the current economy putting many Kiwi households under financial pressure. In a November 2022 survey by Ipsos, financial stress took the top spot for factors impacting on New Zealanders’ mental wellbeing.

So what can be done? Te Ara Ahunga Ora Director of Financial Capability Nick Thomson says he’s not surprised that these stressors distract employees at work, as it’s basic human instinct to prioritise the factors that support our survival. He believes the key to easing this pressure is boosting financial confidence.

“It’s completely natural for our money worries to come to work with us. If your mortgage payments have increased $200 a week, or you’ve seen your KiwiSaver balance drop $5000, it’s not easy to put those thoughts aside the moment you walk in the office.”

This is where the power of financial knowledge comes in, says Thomson. As people learn more about the forces at play and the factors affecting their personal finances, they become more resilient when times get tough.

“We know that the better we understand our finances, the more choices we feel we have. If our retirement savings drop, we can rest easier knowing that it’s just a cycle and they will recover. Or if we’re struggling to make ends meet, we know of certain levers that can be pulled to help get us through.”

Simple steps like knowing how to create a budget, build up an emergency fund, or understand the difference between “good” and “bad” debt can give people a lot more power and peace of mind with their finances.

This was what inspired Te Ara Ahunga Ora to create Sorted at Work, a suite of financial capability courses delivered in workplaces across Aotearoa.

The government-backed programme has so far been delivered in 109 workplaces, in various sectors including education, public sector, construction, and retail. More than 13,000 employees have completed a Sorted at Work course, with topics including investing, retirement, home ownership and more.

Sorted at Work Learning Delivery Specialist Natalie Palmer says that by providing staff with financial education, employers are sending a clear message that their employees’ wellbeing is important to them.

“You’re communicating to your staff that their wellbeing really matters. We’ve seen that when you show you have your people’s best interests at heart, it doesn’t just improve their situation at home, it also makes them more motivated at work. You become a more attractive employer too, because you’re saying we care about our people, and if you join us we’ll do what we can to look after you.”

Sorted at Work

The Sorted at Work Programme includes a suite of courses and seminars you can select from and have delivered in your workplace by one of the Te Ara Ahunga Ora affiliated facilitators located nationwide. You can opt to run any number of these offerings to suit the needs of your workforce, knowing that:

- the design and delivery of the programme is quality assured

- offerings are updated and enhanced with supporting materials remaining current, accurate, neutral and impartial

- the supporting Sorted calculators, plans, tools and resources are continuously improved to support your employees to take charge of their financial futures

- participants will experience “aha” moments that lead to real change in their lives for a healthier and wealthier economic future.

Want to take a pulse check of your people? A short “pulse check” survey can tell you a great deal about the financial capability of your team and where the needs are. Get in touch.